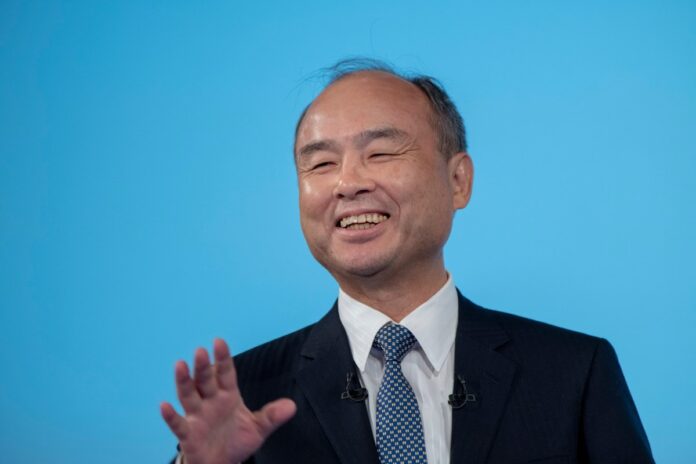

SoftBank founder Masayoshi Son has a reputation for bold bets, swinging between spectacular highs and disastrous lows throughout his career. His latest move—selling the company’s entire $5.8 billion stake in Nvidia to fuel investments in artificial intelligence (AI)—is stirring both excitement and concern in financial markets. While surprising, it perhaps shouldn’t be: Son consistently goes all-in on promising sectors, regardless of the perceived risk.

Son’s history underscores this pattern. In the late 1990s, he rode the dot-com bubble to a record net worth before losing an unprecedented $70 billion when the bubble burst in 2000. His recovery hinged on a seemingly impulsive $20 million investment in Alibaba in 2000, which blossomed into a $150 billion asset by 2020—making him a legend in venture capital. This early success fueled further outsized bets, like the controversial decision to raise $45 billion from Saudi Arabia’s Public Investment Fund in 2017 for SoftBank’s first Vision Fund, even amidst ethical concerns surrounding the kingdom.

While his investment portfolio sometimes leans into unproven ventures, other times it reflects a strong belief in existing success. In this case, Son seems to be shifting away from what has been a remarkably successful position: Nvidia’s stock performance has soared in recent years, and while SoftBank exited at nearly 14% below its all-time high, selling $5.8 billion worth of shares still translates to a significant return.

However, this strategic shift is not about diversification; it’s about doubling down on AI. SoftBank intends to pour $30 billion into OpenAI, a leading player in the AI field, and potentially participate in a massive $1 trillion Arizona hub focused on AI manufacturing. This move suggests Son sees an even more lucrative future in AI than in Nvidia’s established dominance in semiconductors and graphics processing units.

This decisive action sent ripples through the market: Nvidia shares dropped nearly 3% following the news. While analysts downplay concerns about SoftBank’s stance on Nvidia, characterizing the sale as a capital raise for AI endeavors, Son’s track record inevitably invites speculation. Investors are left pondering whether this is another calculated gamble by a shrewd strategist who consistently defies expectations—or if it’s simply another bold swing in a career marked by both stunning successes and costly missteps.